You need to open a “Securities Trading Account” to start trading stock shares and bonds. Click here to open an account.

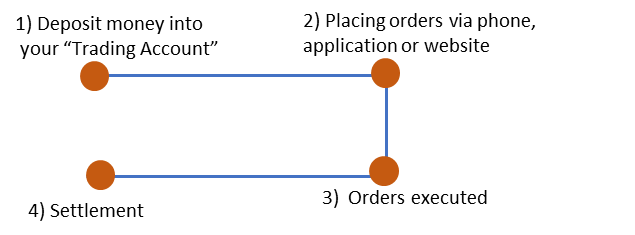

Trading Process

- For Buy orders, please make sure you have sufficient funds in your securities trading account to cover total value of shares, commission fee and 0.1% government Stamp Duty.

- You can place orders by one of the following ways:

- 1. via CB Trader Mobile Application or website

- 2. via phone call

- 3. In person in CB Securities Head Office

Orders Executed

- If your order is executed, you will receive the following emails.

- 1. Trade Confirmation Letter

- 2. Contract Note

- 3. Transaction withholding Statement

- When your order is not executed at the nearest matching time, it will still be valid for other matching times until market closes unless you cancel. Orders are only valid for one day and have to be re-placed if they were not executed at the last matching time of the day.

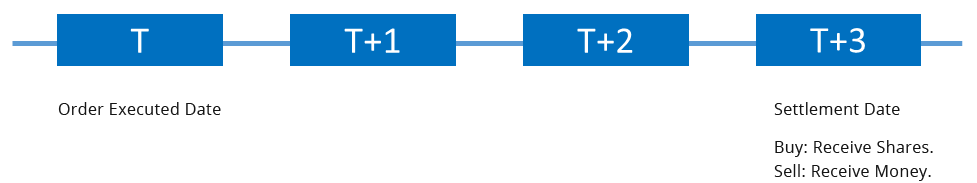

Settlement ( T+3 )

- Settlement take place three day after order executed date.

( Note : : Saturday, Sunday and Public holidays are not taken into account. ) - After Settlement, buyers will get shares and sellers will get money.

( Note : : If you want to sell shares which you buy in previous matching time, you can sell it in next matching time. You don’t need to wait 3 days. If you want to buy shares with money that you get from selling shares in previous matching time, you only need to wait till next day. But if you want to withdraw that money, you need to wait 3 days.

Commission Fee

| Trading Amount | Fee |

| Less than 1,000,000 Kyats | 1.0% of Trading Amount |

| Between 1,000,001 – 10,000,000 Kyats | 0.7% of Trading Amount |

| Between 10,000,001 – 100,000,000 Kyats | 0.5% of Trading Amount |

| More Than 100,000,000 Kyats | 0.4% of Trading Amount |

- Buy Orders also have to pay additional 0.1% for Stamp Duty.

Trading Hours

- In YSX, matching take place seven times a day.

- 10:00 AM

- 10:30 AM

- 11:00 AM

- 11:30 AM

- 12:00 PM

- 12:30 PM

- 1:00 PM

- Market trading hours are from 9:30 am to 1:00 pm.

- Placing orders after 1:00 PM are processed as After Market Order (AMO) and will be queued at first matching time next day when the market opens.

Upper/Lower Limit and Tick Size

| Base Price (MMK) | Price Limit (MMK) (upper/lower) | Tick Size (MMK) | |

| From | Below | ||

| 1,000 | 100 | 10 | |

| 1,000 | 2,000 | 250 | 50 |

| 2,000 | 4,000 | 500 | 50 |

| 4,000 | 10,000 | 1,000 | 100 |

| 10,000 | 20,000 | 2,500 | 500 |

| 20,000 | 40,000 | 5,000 | 500 |

| 40,000 | 100,000 | 10,000 | 1000 |

- Upper Limit means the maximum a share price can move up during a day.

- Lower Limit means the maximum a share price can move down during a day.

- Tick Size mean minimum amount you can move up or down when placing orders.

( e.g. If a shares is priced 5,000 kyats, its upper limit is 6,000 kyats , its lower limit is 4,000 kyats and its tick size is 100 kyats. So, you can only place orders such as 5100, 5200, 5500, etc… , not 5150, 5350, 5370, etc… )

Market Order and Limit Order

Market Order

- Market Orders are buying and selling of share without setting a specific price. It also mean that you want to buy and sell shares at current market price.

- Market Orders have higher priority at matching than Limit Orders.

- Market Order have higher probability of being executed than limit orders.

Limit Order

- Limit Orders are buying and selling of share by setting a specific price.

- Limit orders will not be executed unless the preset price is reached.

- Limit Orders are lower priority than Market Orders at matching.

Priority

- Price priority: The order price that is superior than other orders gets filled first and a market order has the first price priority.

- Time priority: If the price priority is same, earlier order has priority to get filled first.

- For more information on matching methods of Yangon Stock Exchange, please read here on Yangon Stock Exchange website.

01 8610331

01 8610331 contact@cbsecurities.com.mm

contact@cbsecurities.com.mm